39+ can i claim mortgage interest on taxes

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. For taxpayers who use.

Mortgage Interest Deduction Bankrate

If you are on the deed with someone else you should divide the amounts you paid and report them.

. The 1098 is in someone elses name not a seller-financed loan but you. However if your property operates as a. If the Mortgage Interest is for your main home you would enter the.

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web Then yes you can enter the interest paid on the mortgage.

There is no specific mortgage interest deduction unmarried couples can take. Web The interest you pay for your mortgage can be deducted from your taxes. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Start basic federal filing for free. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. A general rule of thumb is the person paying the expense gets to take the.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Ad Over 90 million taxes filed with TaxAct.

Web Up to 96 cash back Answer No. The FDIC insures the banks deposits. Filing your taxes just became easier.

Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year.

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used. Web In the event of a bank failure the FDIC says it has two roles.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Homeowners who bought houses before.

Web When entering the 1098 only enter the amount that you actually paid not the full amount. The write-off is limited to interest on up to 750000 375000 for married-filing. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

TaxInterest is the standard that helps you calculate the correct amounts. File your taxes stress-free online with TaxAct. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. As the receiver the FDIC sells and collects the assets of.

Companies are required by law to send W-2 forms to. Web If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro-rated portion of that lump sum is deductible in the tax year it was paid.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore

Maximum Mortgage Tax Deduction Benefit Depends On Income

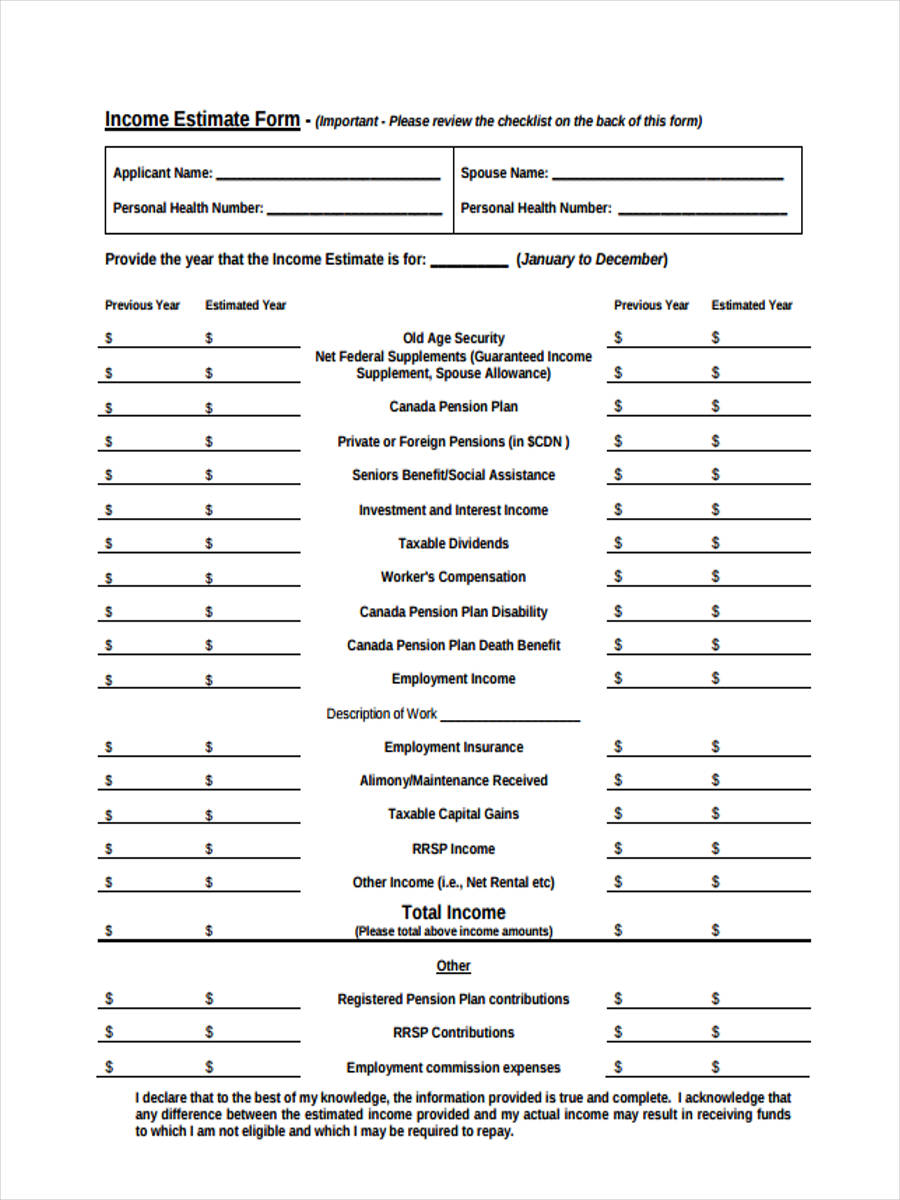

Free 39 Estimate Forms In Pdf Ms Word

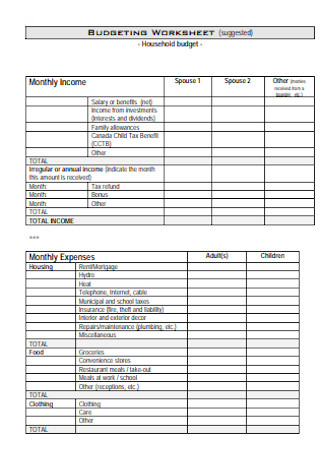

39 Sample Household Budgets In Pdf Ms Word

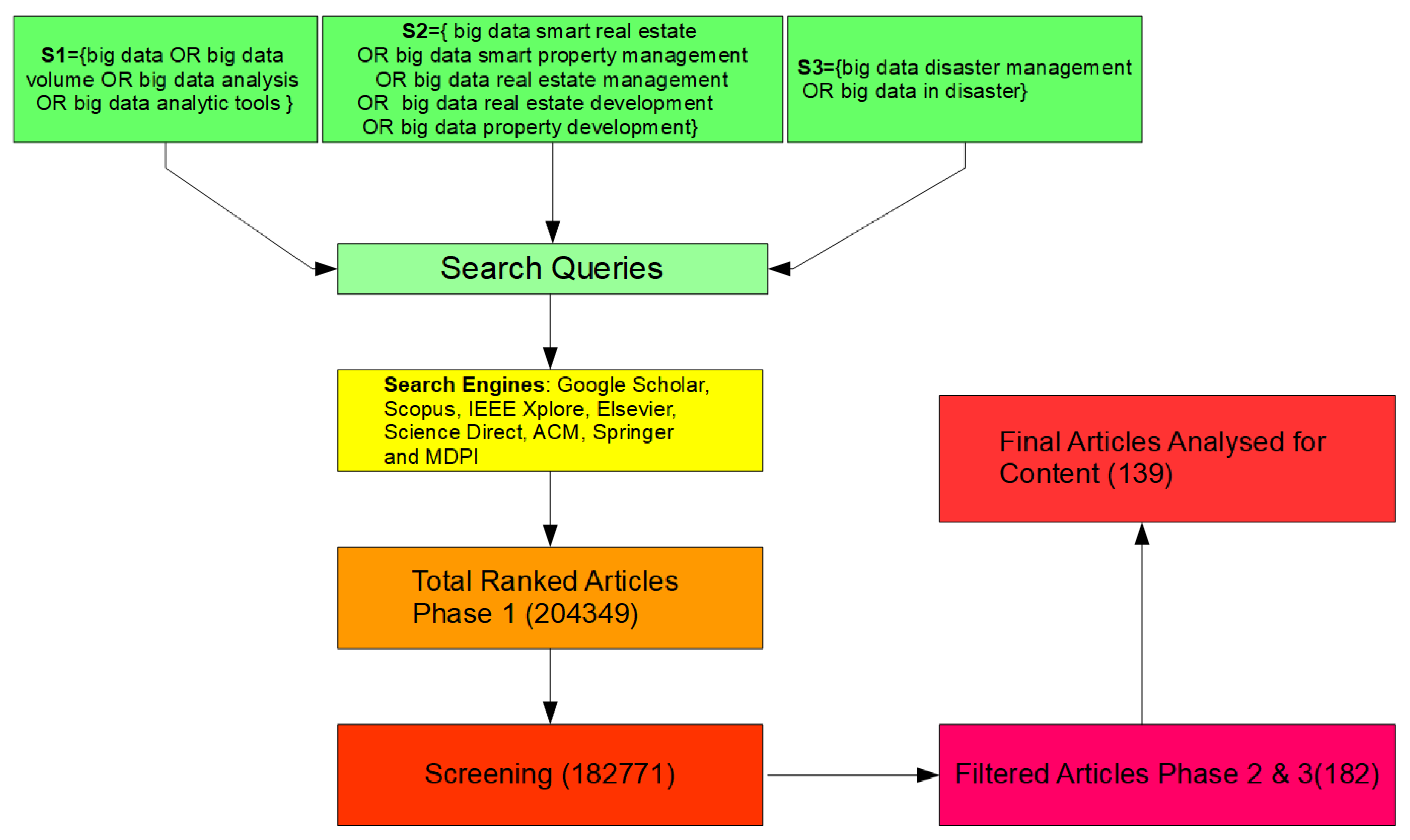

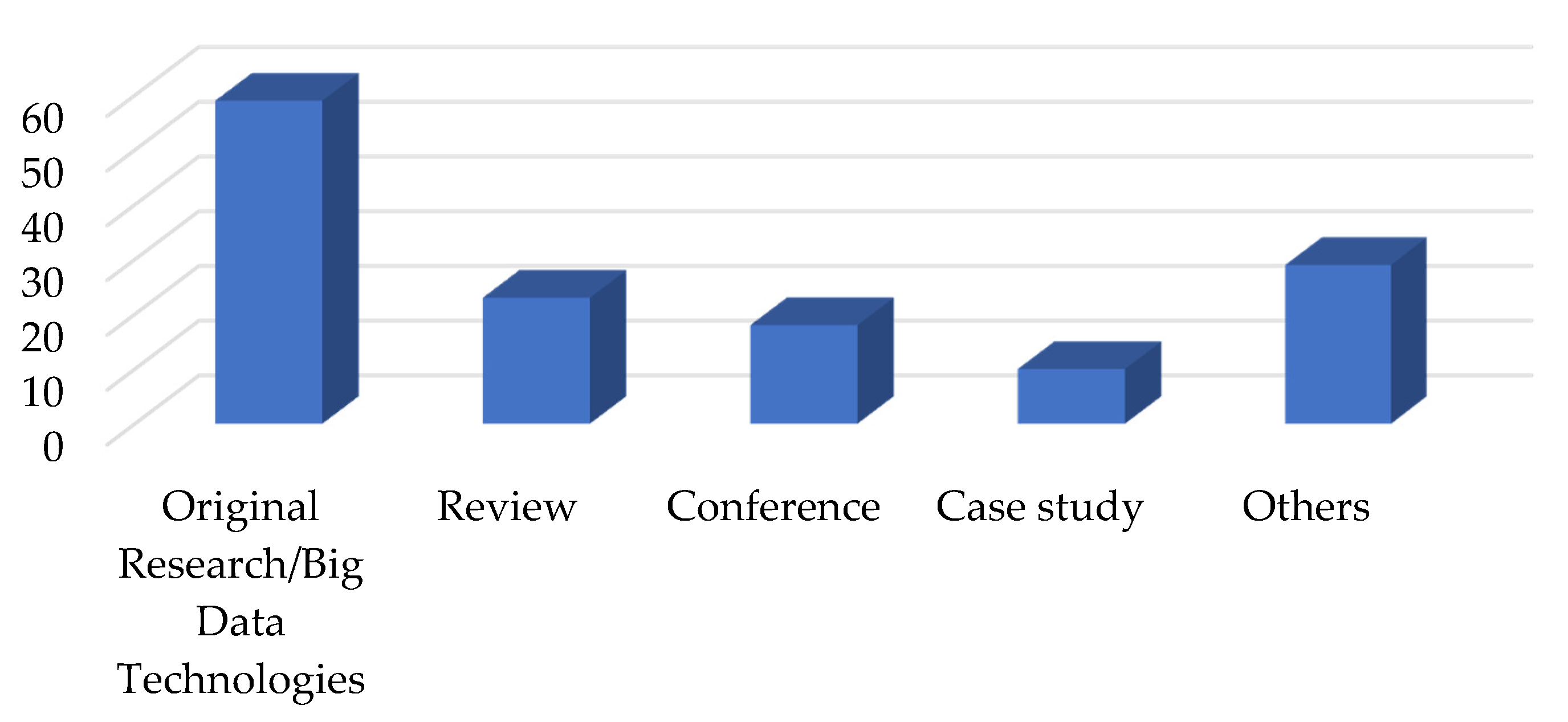

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Changes To Tax Relief For Residential Property Landlords Business Clan

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

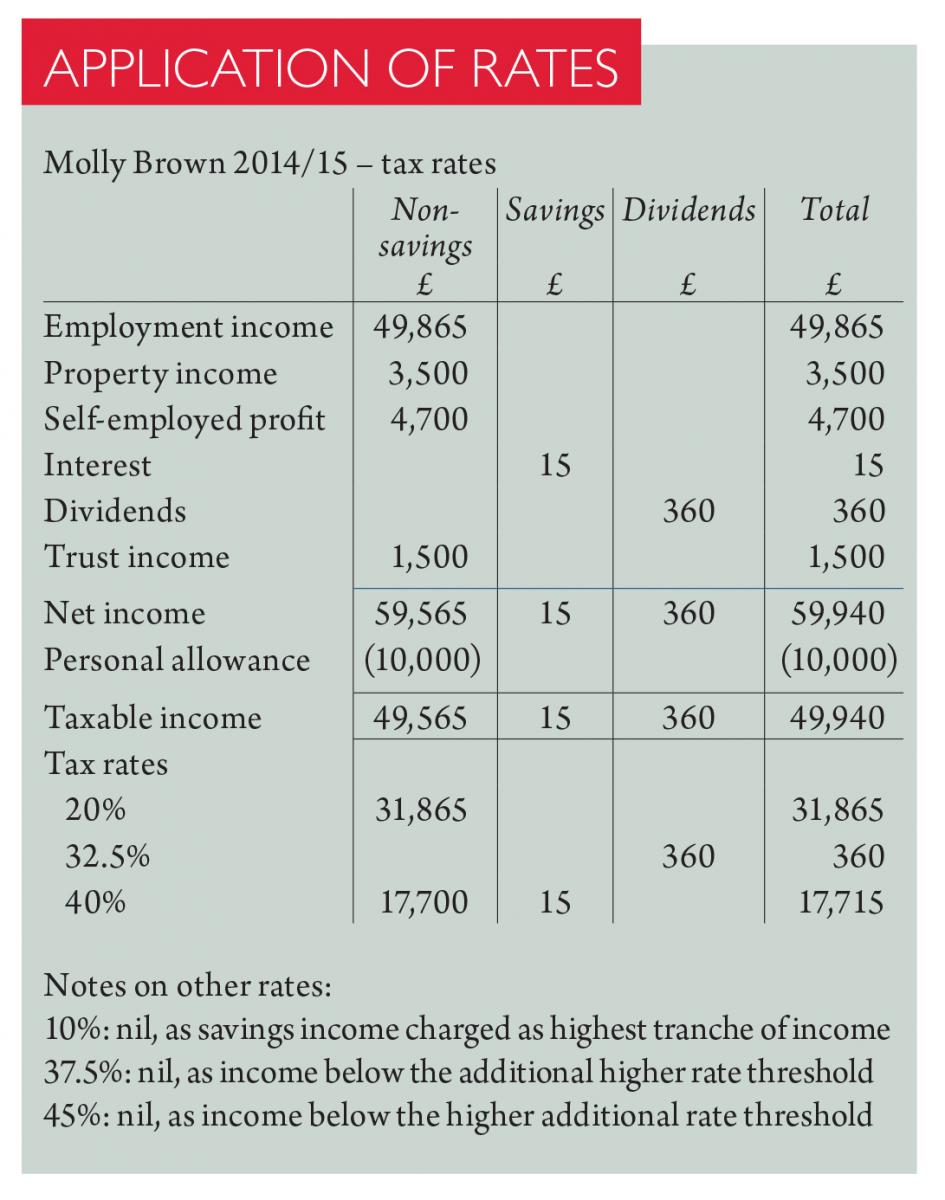

Seven Steps To Heaven Taxation

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

06 June Cbws Homes Mag By Schmidt Family Of Companies Issuu

India Herald 082714 By India Herald Issuu